Frame image

318

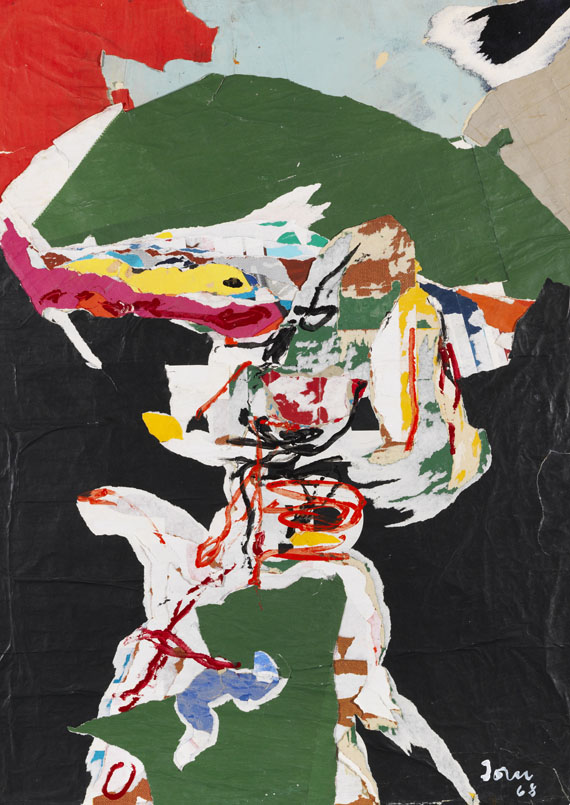

Asger Jorn

Helicodimetre pertorituelle, 1964.

Décollage on cardboard, on panel

Estimate:

€ 20,000 - 30,000

$ 22,000 - 33,000

Helicodimetre pertorituelle. 1964.

Décollage on cardboard, on panel.

Signed and dated lower right. Once again signed and dated on the reverse, as well as titled and inscribed with the work number “Nº26”. Visible area: 48.5 x 64.5 cm (19 x 25.3 in).

[AR].

• Early Décollage: Jorn created his first works in this distinctive technique in 1964.

• Using torn-up advertising posters, Jorn developed works with a unique aesthetic, allowing new, imaginative compositions to emerge layer by layer.

• This extremely complex work oscillates between abstraction and figuration, utilizing word fragments and a playful title to encourage narrative interpretations.

• In the year of its creation, the artist took part in the documenta in Kassel for the second time after 1959.

The work is registered in the Jorn Archiv, Silkeborg (Museum Jorn).

PROVENANCE: J. Peter Cochrane Collection, London (with a handwritten note on the reverse).

Martin Summers Fine Art LTD., London (with a label on the reverse).

From a Swiss collection.

EXHIBITION: Asger Jorn and Eugène Dodeigne, Kunsthalle Basel, October 24-November 22, 1964, cat. no. 105.

Asger Jorn: schilderijenStedelijk Museum, Amsterdam, December 11, 1964 - January 25, 1965, cat. no. 126.

Asger Jorn, Louisiana Museum of Modern Art, February 6 - 28, 1965, cat. no. 129.

Fixsterne, 100 Jahre Kunst auf Papier. Adolph Menzel bis Kiki Smith, Stiftung Schleswig Holsteinische Landesmuseen, Schloß Gottorf, May 31 - Sept. 20, 2009, p. 89 (illustrated in color, with label on the reverse)

Ganz schön gerissen! Asger Jorns Collagen und Décollagen, Kunsthalle Emden, October 25, 2014 - January 18, 2015, p. 54 (illustrated in color).

LITERATURE: Sotheby's London, June 19, 2006, lot 637.

Called up: December 7, 2024 - ca. 16.09 h +/- 20 min.

Décollage on cardboard, on panel.

Signed and dated lower right. Once again signed and dated on the reverse, as well as titled and inscribed with the work number “Nº26”. Visible area: 48.5 x 64.5 cm (19 x 25.3 in).

[AR].

• Early Décollage: Jorn created his first works in this distinctive technique in 1964.

• Using torn-up advertising posters, Jorn developed works with a unique aesthetic, allowing new, imaginative compositions to emerge layer by layer.

• This extremely complex work oscillates between abstraction and figuration, utilizing word fragments and a playful title to encourage narrative interpretations.

• In the year of its creation, the artist took part in the documenta in Kassel for the second time after 1959.

The work is registered in the Jorn Archiv, Silkeborg (Museum Jorn).

PROVENANCE: J. Peter Cochrane Collection, London (with a handwritten note on the reverse).

Martin Summers Fine Art LTD., London (with a label on the reverse).

From a Swiss collection.

EXHIBITION: Asger Jorn and Eugène Dodeigne, Kunsthalle Basel, October 24-November 22, 1964, cat. no. 105.

Asger Jorn: schilderijenStedelijk Museum, Amsterdam, December 11, 1964 - January 25, 1965, cat. no. 126.

Asger Jorn, Louisiana Museum of Modern Art, February 6 - 28, 1965, cat. no. 129.

Fixsterne, 100 Jahre Kunst auf Papier. Adolph Menzel bis Kiki Smith, Stiftung Schleswig Holsteinische Landesmuseen, Schloß Gottorf, May 31 - Sept. 20, 2009, p. 89 (illustrated in color, with label on the reverse)

Ganz schön gerissen! Asger Jorns Collagen und Décollagen, Kunsthalle Emden, October 25, 2014 - January 18, 2015, p. 54 (illustrated in color).

LITERATURE: Sotheby's London, June 19, 2006, lot 637.

Called up: December 7, 2024 - ca. 16.09 h +/- 20 min.

318

Asger Jorn

Helicodimetre pertorituelle, 1964.

Décollage on cardboard, on panel

Estimate:

€ 20,000 - 30,000

$ 22,000 - 33,000

Buyer's premium, taxation and resale right compensation for Asger Jorn "Helicodimetre pertorituelle"

This lot can be subjected to differential taxation plus a 7% import tax levy (saving approx. 5 % compared to regular taxation) or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 318

Lot 318