317

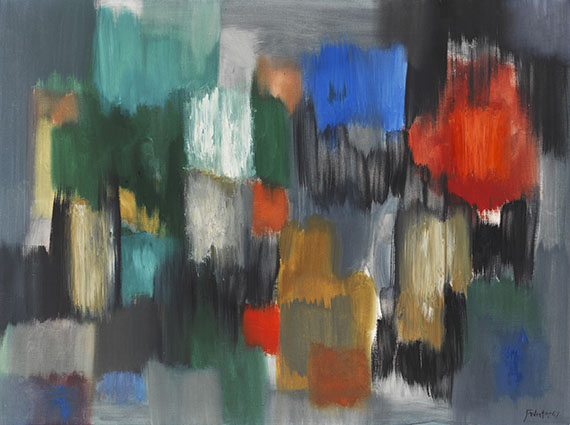

Fritz Winter

Ein Tag, 1963.

Oil on canvas

Estimate:

€ 35,000 - 45,000

$ 38,500 - 49,500

Ein Tag. 1963.

Oil on canvas.

Signed and dated lower right. Once again signed, dated and titled on the reverse of the canvas. 80.5 x 90.5 cm (31.6 x 35.6 in).

[AR].

• Fritz Winter's works from the 1960s are dominated by color.

• The rectangles seem to merge and yet stand out in stark contrast.

• Winter's luminous rectangular and row paintings from this period are among the artist's most sought-after works on the international auction market (source: artprice.com).

Accompanied by an expert report from Dr. Gabriele Lohberg, Krefeld, dated November 11, 2024.

PROVENANCE: Private collection, Germany

Private collection, Southern Germany.

Called up: December 7, 2024 - ca. 16.07 h +/- 20 min.

Oil on canvas.

Signed and dated lower right. Once again signed, dated and titled on the reverse of the canvas. 80.5 x 90.5 cm (31.6 x 35.6 in).

[AR].

• Fritz Winter's works from the 1960s are dominated by color.

• The rectangles seem to merge and yet stand out in stark contrast.

• Winter's luminous rectangular and row paintings from this period are among the artist's most sought-after works on the international auction market (source: artprice.com).

Accompanied by an expert report from Dr. Gabriele Lohberg, Krefeld, dated November 11, 2024.

PROVENANCE: Private collection, Germany

Private collection, Southern Germany.

Called up: December 7, 2024 - ca. 16.07 h +/- 20 min.

317

Fritz Winter

Ein Tag, 1963.

Oil on canvas

Estimate:

€ 35,000 - 45,000

$ 38,500 - 49,500

Buyer's premium, taxation and resale right compensation for Fritz Winter "Ein Tag"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 317

Lot 317