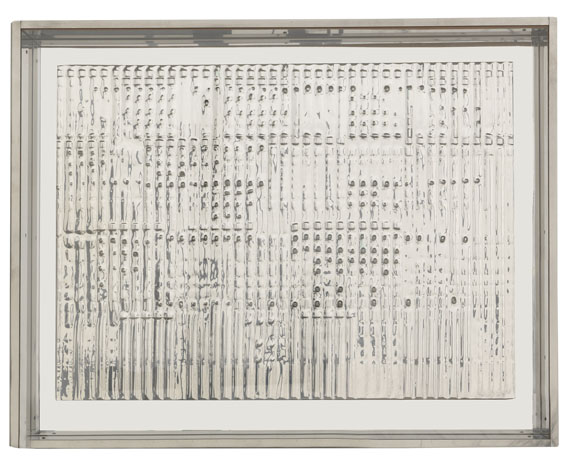

Back side

382

Heinz Mack

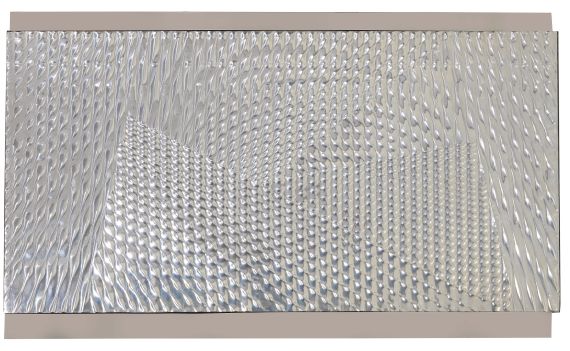

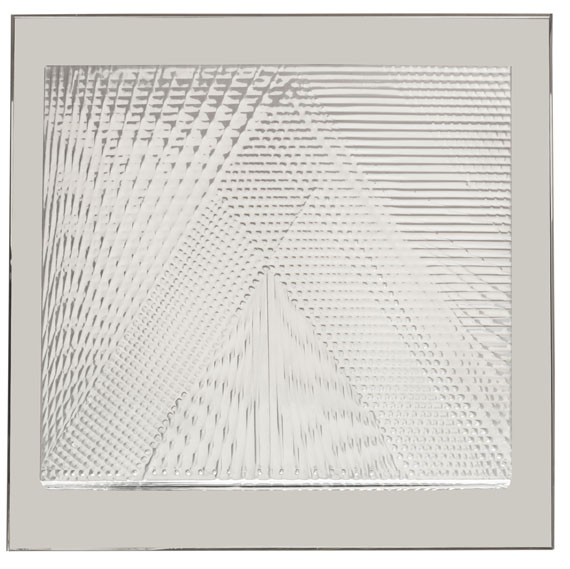

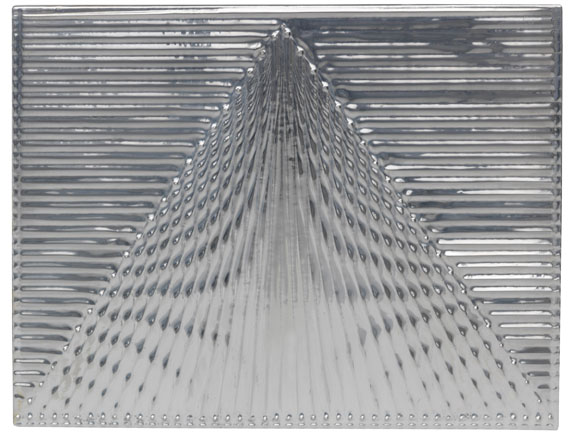

Lichtrelief, 1968.

Relief, aluminum on wood

Estimate:

€ 40,000 - 60,000

$ 44,000 - 66,000

Lichtrelief. 1968.

Relief, aluminum on wood.

Signed, dated and inscribed with the title and a direction arrow on the reverse. 63 x 79 cm (24.8 x 31.1 in).

[AR].

• Early work that exemplifies the "ZERO" artist's quest to give artistic form to the sky, air and light.

• A unique object from the important work group of reliefs.

• The artist has dedicated himself to this medium for more than 60 years.

• In addition to light reliefs, he also creates white, silver and gold reliefs, sand reliefs, and grid reliefs.

• Most recenty, the ZKM in Karlsruhe presented an extensive solo exhibition of his work in 2023.

Accompanied by a certificate issued by the Atelier Heinz Mack, Mönchengladbach, from November 2023.

PROVENANCE: Galerie Cuenca, Ulm.

Private collection, Baden-Württemberg.

EXHIBITION: Internationaler Kunstmarkt Köln, Galerie Reckermann, fairgrounds Köln-Deutz, October 19 - October 24, 1974 (with the label on the reverse).

"My metal reliefs, which I prefer to call light reliefs and which are formed solely by the pressure of the fingers, need light instead of color in order to come to life. Polished to a mirror finish, a slight relief structure is enough to shake the calm of the light and set it in vibration. The possible beauty of these structures would be a pure expression of the beauty of light."

Heinz Mack, quoted from: Daniels/John, Cremer Collection I, 1991, p. 142f.

Called up: December 7, 2024 - ca. 17.34 h +/- 20 min.

Relief, aluminum on wood.

Signed, dated and inscribed with the title and a direction arrow on the reverse. 63 x 79 cm (24.8 x 31.1 in).

[AR].

• Early work that exemplifies the "ZERO" artist's quest to give artistic form to the sky, air and light.

• A unique object from the important work group of reliefs.

• The artist has dedicated himself to this medium for more than 60 years.

• In addition to light reliefs, he also creates white, silver and gold reliefs, sand reliefs, and grid reliefs.

• Most recenty, the ZKM in Karlsruhe presented an extensive solo exhibition of his work in 2023.

Accompanied by a certificate issued by the Atelier Heinz Mack, Mönchengladbach, from November 2023.

PROVENANCE: Galerie Cuenca, Ulm.

Private collection, Baden-Württemberg.

EXHIBITION: Internationaler Kunstmarkt Köln, Galerie Reckermann, fairgrounds Köln-Deutz, October 19 - October 24, 1974 (with the label on the reverse).

"My metal reliefs, which I prefer to call light reliefs and which are formed solely by the pressure of the fingers, need light instead of color in order to come to life. Polished to a mirror finish, a slight relief structure is enough to shake the calm of the light and set it in vibration. The possible beauty of these structures would be a pure expression of the beauty of light."

Heinz Mack, quoted from: Daniels/John, Cremer Collection I, 1991, p. 142f.

Called up: December 7, 2024 - ca. 17.34 h +/- 20 min.

382

Heinz Mack

Lichtrelief, 1968.

Relief, aluminum on wood

Estimate:

€ 40,000 - 60,000

$ 44,000 - 66,000

Buyer's premium, taxation and resale right compensation for Heinz Mack "Lichtrelief"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 382

Lot 382