327

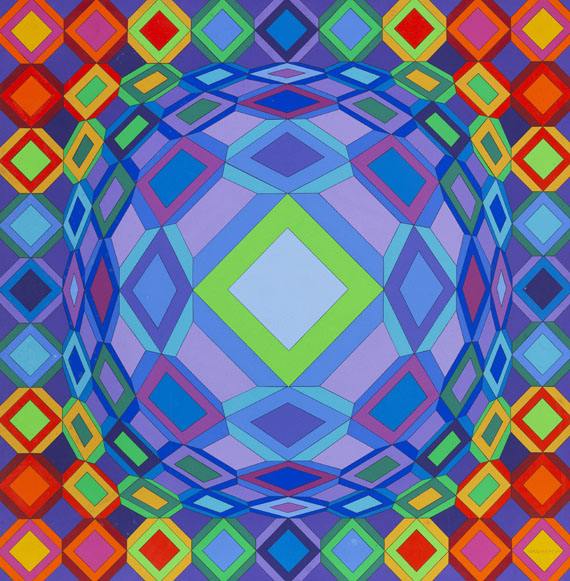

Victor Vasarely

EBI-NOOR-2, 1951/1958.

Acrylic on cardboard on cardboard, originally l...

Post auction sale: € 18,000 / $ 19,800

EBI-NOOR-2. 1951/1958, 1971.

Acrylic on cardboard on cardboard, originally laminated on panel.

Signed bottom center. Dated, titled and numbered “013” on the reverse of the wooden panel. 53.9 x 32 cm (21.2 x 12.5 in). [CH].

• Vasarely created a stunning optical illusion by means of a labyrinth of jagged interwoven lines.

• As a co-founder and one of the most important representatives of Op Art, Vasarely participated four times in the documenta in Kassel: in 1955, 1959, 1964 and 1968.

• His visionary work was most recently honored with comprehensive retrospectives at the Museo Nacional Thyssen-Bornemisza, Madrid (2018), the Städel Museum, Frankfurt am Main (2018), and the Centre Pompidou, Paris (2019).

The authenticity of the work has been confirmed by Mr. Pierre Vasarely, President of the Vasarely Foundation, universal legatee and holder of the moral rights of Mr. Victor Vasarely. This work will be included in the catalogue raisonné of the artist's paintings, prepared by the Vasarely Foundation, Aix-en-Provence.

PROVENANCE: Denise René Gallery, Paris (verso on the wooden panel with the typographic gallery label).

Private collection, Switzerland.

Private collection, Hesse (acquired from the above in 1992, Ketterer Kunst, Munich, November 30, 1992, lot 368).

Private collection, North Rhine-Westphalia (acquired from the above).

LITERATURE: Ketterer Kunst, Munich, auction 178, Modern Art I, November 30, 1992, lot 368 (full-page illu. in color.

Acrylic on cardboard on cardboard, originally laminated on panel.

Signed bottom center. Dated, titled and numbered “013” on the reverse of the wooden panel. 53.9 x 32 cm (21.2 x 12.5 in). [CH].

• Vasarely created a stunning optical illusion by means of a labyrinth of jagged interwoven lines.

• As a co-founder and one of the most important representatives of Op Art, Vasarely participated four times in the documenta in Kassel: in 1955, 1959, 1964 and 1968.

• His visionary work was most recently honored with comprehensive retrospectives at the Museo Nacional Thyssen-Bornemisza, Madrid (2018), the Städel Museum, Frankfurt am Main (2018), and the Centre Pompidou, Paris (2019).

The authenticity of the work has been confirmed by Mr. Pierre Vasarely, President of the Vasarely Foundation, universal legatee and holder of the moral rights of Mr. Victor Vasarely. This work will be included in the catalogue raisonné of the artist's paintings, prepared by the Vasarely Foundation, Aix-en-Provence.

PROVENANCE: Denise René Gallery, Paris (verso on the wooden panel with the typographic gallery label).

Private collection, Switzerland.

Private collection, Hesse (acquired from the above in 1992, Ketterer Kunst, Munich, November 30, 1992, lot 368).

Private collection, North Rhine-Westphalia (acquired from the above).

LITERATURE: Ketterer Kunst, Munich, auction 178, Modern Art I, November 30, 1992, lot 368 (full-page illu. in color.

327

Victor Vasarely

EBI-NOOR-2, 1951/1958.

Acrylic on cardboard on cardboard, originally l...

Post auction sale: € 18,000 / $ 19,800

Buyer's premium, taxation and resale right compensation for Victor Vasarely "EBI-NOOR-2"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 327

Lot 327