120

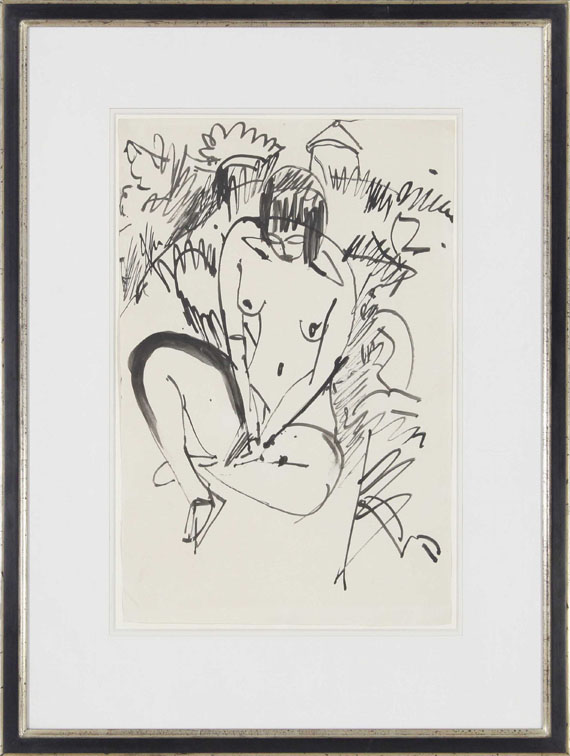

Ernst Ludwig Kirchner

Sitzende in Dünen - Fehmarn, 1912.

Brush and India ink drawing

Estimate:

€ 20,000 / $ 21,400 Sold:

€ 25,000 / $ 26,750 (incl. surcharge)

Sitzende in Dünen - Fehmarn. 1912.

Brush and India ink drawing.

Verso with the estate stamp (Lugt 1570b) and the hand-written number "F Be/Bf 9". On thin wove paper. 47 x 30.6 cm (18.5 x 12 in), size of sheet. [CH].

• Part of the same private collection for 60 years.

• Spirited nude from Kirchner's second trip to Fehmarn with his partner Erna Schilling in the summer of 1912.

• Created the same time as paintings with depictions from Fehmarn, including "Badende zwischen Steinen" (1912, Gordon 256), "Ins Meer Schreitende" (1912, Gordon 262, Staatsgalerie Stuttgart) and "Akt mit Hut am Strand" (1912, Gordon 265), which are reminiscent of the drawing offered here in terms of composition, posture of the figures or image structure.

PROVENANCE: Artist's estate (Davos 1938, Kunstmuseum Basel 1946).

Galerie Nierendorf, Berlin.

Private collection (acquired from the above in 1961).

Brush and India ink drawing.

Verso with the estate stamp (Lugt 1570b) and the hand-written number "F Be/Bf 9". On thin wove paper. 47 x 30.6 cm (18.5 x 12 in), size of sheet. [CH].

• Part of the same private collection for 60 years.

• Spirited nude from Kirchner's second trip to Fehmarn with his partner Erna Schilling in the summer of 1912.

• Created the same time as paintings with depictions from Fehmarn, including "Badende zwischen Steinen" (1912, Gordon 256), "Ins Meer Schreitende" (1912, Gordon 262, Staatsgalerie Stuttgart) and "Akt mit Hut am Strand" (1912, Gordon 265), which are reminiscent of the drawing offered here in terms of composition, posture of the figures or image structure.

PROVENANCE: Artist's estate (Davos 1938, Kunstmuseum Basel 1946).

Galerie Nierendorf, Berlin.

Private collection (acquired from the above in 1961).

120

Ernst Ludwig Kirchner

Sitzende in Dünen - Fehmarn, 1912.

Brush and India ink drawing

Estimate:

€ 20,000 / $ 21,400 Sold:

€ 25,000 / $ 26,750 (incl. surcharge)

Lot 120

Lot 120